Fujifilm X and GFX Sales Surge in Q1/2025 — Now Close to “Goldmine” Instax Revenue

The latest Fujifilm financial results are out (Q1/2025 – April to June 2025).

Interestingly, Fujifilm makes an estimate of the impact of U.S. tariffs for each segment, except for the imaging division

- health care = – 4.0 billion yen

- electronics = – 1.0 billion yen

- business innovation = – 1.0 billion yen

- imaging = no information

A positive mention (strong sales) goes to the Fujifilm X100VI, Fujifilm X-T50, Fujifilm GFX100SII and Fujifilm X-M5 and as far as Fujifilm GFX100RF and X half goes, they just say they “contributed” to the results. In the Instax world sales were strong for instax WIDE 400 and instax WIDE Evo.

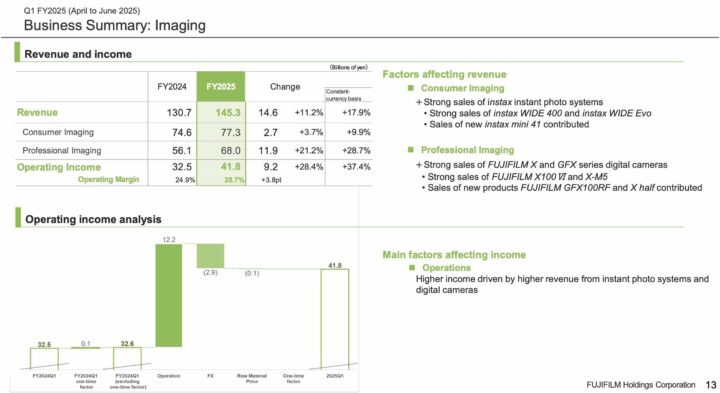

Also interesting: professional imaging (mainly X and GFX) is growing much stronger than consumer imaging (mainly Instax).

In the latest report, consumer imaging sales (mainly Instax) reached ¥77.3 billion, while professional imaging sales (mainly X and GFX) brought in ¥68 billion.

It’s quite astonishing that X/GFX sales are now making Fujifilm almost as much money as Instax sales, which the Fujifilm CEO called their new goldmine. I guess that’s a promising trend for our beloved X/GFX series.

In short:

- Strong demand for instant photo systems and digital cameras drove revenue by 11.2% year-over-year to JPY145.3 billion and operating income surged by 28.4% year-over-year to JPY41.8 billion.

- In the Consumer Imaging business, consistent demand for instax™ instant photo systems contributed to higher revenue.

- In the Professional Imaging business, revenue growth was supported by the strong performance of the X Series and GFX Series cameras.

Fujifilm’s imaging forecast remains the same as the one issued in May 2025, with no updates in the latest report.

Fujifilm Announces Financial Results for the First Quarter Ended June 30, 2025

TOKYO, August 6, 2025 – FUJIFILM Holdings Corporation announced today its financial results for the first quarter, which ended June 30, 2025. In the first three months of the fiscal year ending March 2026, revenue increased by 0.1% year-over-year to JPY749.5 billion. This growth was primarily driven by a strong performance in the Bio CDMO, Semiconductor Materials and Imaging businesses, which offset the negative impact of exchange rates. Operating income rose across all segments, with the Imaging segment making a significant contribution, achieving a 21.1% year-over-year increase to JPY75.3 billion. Net income attributable to FUJIFILM Holdings decreased by 11.5% year-over-year to JPY53.8 billion, mainly due to foreign exchange losses.

The company has maintained its full-year consolidated forecast for the fiscal year ending March 2026, despite accounting for the potential negative impact of the U.S. Tariff Policy, which was not incorporated in the previous forecast. The forecasted revenue is JPY3.28 trillion, with an operating income of JPY331.0 billion, and a net income attributable to FUJIFILM Holdings of JPY262.0 billion, aiming to achieve its record highs. The annual dividend forecast for the fiscal year is JPY70 per share, marking the 16th consecutive annual dividend increase.

“Our strong performance in the first quarter, driven by robust growth in the Bio CDMO, Semiconductor Materials and Imaging, enabled us to achieve unprecedented revenue and operating income for this period. Notably, the operating income increased across all segments, underscoring the growing profitability of our businesses,” says Teiichi Goto, president and chief executive officer, representative director, FUJIFILM Holdings Corporation. “We are pleased to have started this fiscal year with such strong growth momentum, putting us firmly on track to achieve record-high revenue and profits.”

First-quarter financial highlights from April to June by business segments

Healthcare

- Revenue amounted to JPY228.5 billion, a slight decrease of 2.9% from the previous year and operating income increased by 20.7% year-over-year to JPY4.3 billion.

- In the Medical Systems business, revenue decreased primarily due to reduced demand for medical materials in China.

- In the Bio CDMO business, revenue increased due to contribution at the new facility in Denmark, as well as the recovery of operations at the Texas site in the U.S.

- In the LS Solutions business, revenue increased due to the recovery of the markets for cell culture media, as well as strong demand for chemical reagents.

Electronics

- Revenue amounted to JPY102.1 billion, a slight decrease of 0.9% from the previous year and operating income grew by 13.0% year-over-year to JPY22.5 billion.

- In the Electronic Materials business, revenue increased by 3.8% year-over-year, driven by a strong demand for advanced semiconductor materials used in generative AI.

- In the Advanced Functional Materials business, revenue decreased by 8.2% year-over-year primarily due to the impact of large deals with IT companies in the previous year.

Business Innovation

- Revenue amounted to JPY273.6 billion, a slight decrease of 2.3% from the previous year and operating income increased by 7.9% year-over-year, amounting to JPY15.6 billion.

- In the Business Solutions business, revenue growth was primarily driven by a strong performance of solutions related to digital transformation.

- The Office Solutions business saw a decrease in revenue as a result of streamlining the sales of low-margin products for the Chinese market.

- In the Graphic Communications business, revenue decreased mainly due to the discontinuation of low-margin product offerings.

Imaging

- Strong demand for instant photo systems and digital cameras drove revenue by 11.2% year-over-year to JPY145.3 billion and operating income surged by 28.4% year-over-year to JPY41.8 billion.

- In the Consumer Imaging business, consistent demand for instax™ instant photo systems contributed to higher revenue.

- In the Professional Imaging business, revenue growth was supported by the strong performance of the X Series and GFX Series cameras.

via Fujifilm