Fujifilm X and GFX Sales Surge in Q1/2025 — Now Close to “Goldmine” Instax Revenue

The latest Fujifilm financial results are out (Q1/2025 – April to June 2025).

Interestingly, Fujifilm makes an estimate of the impact of U.S. tariffs for each segment, except for the imaging division

- health care = – 4.0 billion yen

- electronics = – 1.0 billion yen

- business innovation = – 1.0 billion yen

- imaging = no information

A positive mention (strong sales) goes to the Fujifilm X100VI, Fujifilm X-T50, Fujifilm GFX100SII and Fujifilm X-M5 and as far as Fujifilm GFX100RF and X half goes, they just say they “contributed” to the results. In the Instax world sales were strong for instax WIDE 400 and instax WIDE Evo.

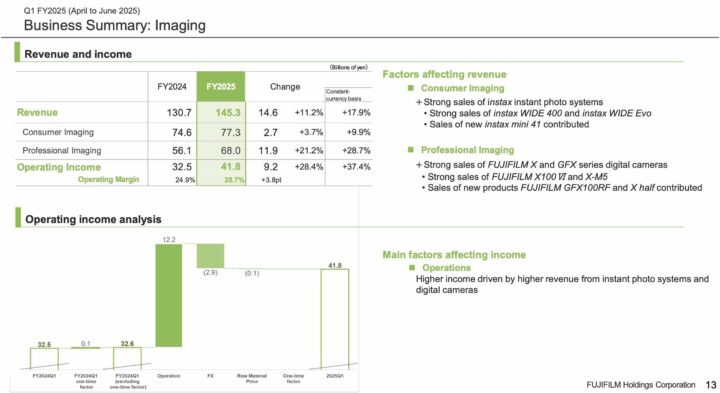

Also interesting: professional imaging (mainly X and GFX) is growing much stronger than consumer imaging (mainly Instax).

In the latest report, consumer imaging sales (mainly Instax) reached ¥77.3 billion, while professional imaging sales (mainly X and GFX) brought in ¥68 billion.

It’s quite astonishing that X/GFX sales are now making Fujifilm almost as much money as Instax sales, which the Fujifilm CEO called their new goldmine. I guess that’s a promising trend for our beloved X/GFX series.

In short:

- Strong demand for instant photo systems and digital cameras drove revenue by 11.2% year-over-year to JPY145.3 billion and operating income surged by 28.4% year-over-year to JPY41.8 billion.

- In the Consumer Imaging business, consistent demand for instax™ instant photo systems contributed to higher revenue.

- In the Professional Imaging business, revenue growth was supported by the strong performance of the X Series and GFX Series cameras.

Fujifilm’s imaging forecast remains the same as the one issued in May 2025, with no updates in the latest report.