Mirrorless Market Share 2020: The Rise of Canon (+6%) Affects Sony (-7%), Fujifilm Stable Third at +5% from Nikon

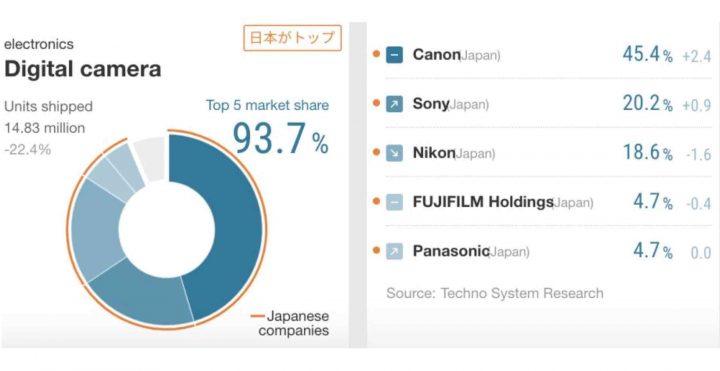

A couple of days ago we have share the market share for the entire digital camera market and we saw that Fujifilm is 4th. We also saw that only Fujifilm, Sony and Canon where able to gain some market share.

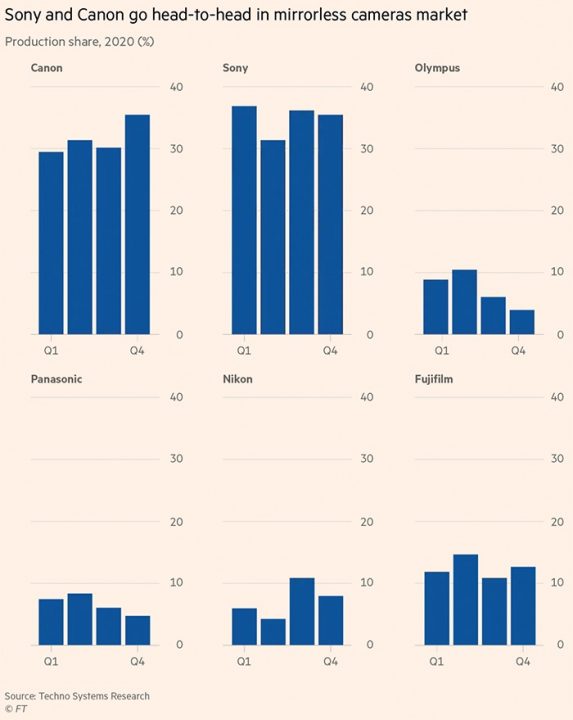

Now SonyAlphaRumors spotted a Financial Times article, where we can see the data for mirrorless cameras market share in 2020.

As usual, the data is provided by Techno System Research, a major marketing research company located in Japan.

We can see that, just as in 2019, Fujifilm is third in the mirrorless camera market share, followed by Olympus, Nikon and Panasonic.

- Sony: about 35%

- Canon: about 30%

- Fujifilm: about 12%

- Nikon: about 7%

Compared to 2019:

Fujifilm is substantially stable with about the same market share of 2019 and still 5% ahead of Nikon.

Sony lost most in terms of market share (-7%). The big winner is Canon, who gained about 6%.

Nikon is on the 4th position.

The dead Olympus has still more market share than Panasonic, who went all-in with full frame mirrorless.

The Fastest Growing Fujifilm Group

- Fujifilm Film Simulation Group (100% Fuji Colors Power)

Follow FujiRumors on Patreon, Facebook, Instagram, RSS-feed, Youtube, Flipboard and Twitter

Join Our Owners Groups

- Fujifilm GFX User Group

- Fujifilm X-T User Group

- Fujifilm X-S User Group

- Fujifilm X-H User Group

- Fujifilm X-E User Group

- Fujifilm X-Pro User Group

- Fujifilm X100 line Group

Join Our Facebook Pages